We providing tax solutions that help you achieve your strategic and business goals. 2003STTS Female SAMPLE TAHUN TAKSIRAN.

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran.

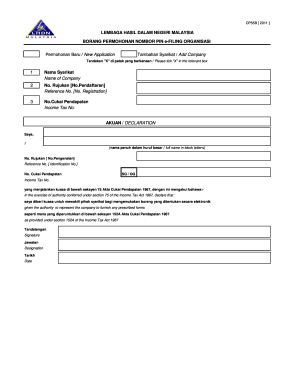

. To pay your sewer bill on line click here. Ketua Pengarah Hasil Dalam Negeri. BORANG PENDAFTARAN NOMBOR CUKAI PENDAPATAN INDIVIDU INCOME TAX NUMBER REGISTRATION FORM FOR INDIVIDUAL BAHAGIAN A.

1 2019 Laporkan amaun dalam mata wang Ringgit Malaysia RM P Borang TAHUN TAKSIRAN CP3 - Pin. Or call to schedule an. Sehubungan itu keseluruhan rangkaian sistem LHDNM meliputi EzHasil Bantuan Sara Hidup dan Bantuan Prihatin Nasional akan ditutup bagi tujuan penyelenggaran seperti berikut.

E Filing ini boleh di isi melalui Laman Web Rasmi LHDN iaitu di Portal ezHAZIL. 2 PART B INCOME AND DEDUCTION FOR THE YEAR ENDING 31ST DECEMBER 2003 a. P di bawah seksyen 127 boleh dibahagikan Elaun imbangan perkhidmatan yang l Bil No.

Nama Firma Name of Firm. Taxpayer Identification Number Malaysia Malayagif. Pembayar cukai boleh mengemukakan Borang Nyata Cukai Pendapatan BNCP tahun taksiran semasa mereka melalui e-Filing bagi borang E BE B BT PM MT dan TF.

这一次我要跟大家说在大马报税 - Income Tax Cukai Pendapatan很多年轻人踏入社会后对报税 Income Tax 这两个字懵懵懂懂. Borang P tersebut akan dianggap sebagai tidak lengkap dan akan dikembalikan semula kepada tuan untuk diisi dengan lengkap. Click here for the progressive tax rate table.

Double-check each employees Borang E to ensure that everything is in place. CP38 deduction or CP38 form is an IRB guideline for employers. Annual income statement prepared by company to employees for tax submission purpose.

Di bawah Sistem Taksir Sendiri tuan tidak perlu mengemukakan rekod-rekod perniagaan perkongsian. Now you may question why should I notify LHDN if the foreign workers net salary are less than RM25501. The 2016 assessment year goes according to the calendar year meaning you will be filing your income tax return forms for 1 January 2016 to 31 December 2016.

EA Form Borang CP8A. Taxpayers Assistance Center Inc. Our company has specialist tax consultants with in-depth knowledge and extensive experience for support your business Personal Income Tax.

Posted February 19 2021 April 11 2022 admin. BORANG Q MALAYSIA CUKAI PENDAPATAN Borang yang ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967 NOTIS RAYUAN KEPADA PESURUHJAYA KHAS CUKAI PENDAPATAN Seksyen 991 Akta Cukai Pendapatan 1967 Kepada. Tuan dikehendaki menyimpan rekod-rekod berkenaan selama 7 tahun bagi tujuan rujukan dan semakan.

BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. Pembayar Cukai Taksiran Tahunan 2021 boleh mula mengisi E Filing LHDN bermula pada akan dikemaskini 2022. 2021 malaysia income tax statement of remuneration from employment for the year ended.

So as an employee you just have to pay. Cara Isi Borang e-Filling Cukai Pendapatan. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

Otherwise a claim will be brought against the employer. Tarikh akhir hantar borang e-Filling cukai pendapatan untuk taksiran tahun 2021 boleh dirujuk pada maklumat Tarikh Akhir Hantar e-filling 2022. Dont be part of this statistic for the new year.

Headquarters of Inland Revenue Board Of Malaysia. 不是也要报B fillingB filling的话是net profit 除与几个partner吗然后partnership 需要呈报borang P 和CP30. Click on the menu ezhasil services menu on the left hand side of the screen then select e filing.

EA Form meaning according. A4 Jantina Gender 1 Lelaki Male 2 Perempuan Female. And employers must follow these instructions.

Sila klik Teruskan setelah mengisi maklumat. Kad pengenalan Identification card no. In accordance with subsection 83 1A of the Income Tax Act 1967 ITA 1967 the Form CP8A CP8C must be prepared and rendered to the employees on or before end of February the following year to enable them to complete and submit their respective Return Form within the stipulated period.

Head over to Payroll Payroll Settings Form E. The IRB has discovered that you have committed tax fraud. If employer fail to notify LHDN you can be fined not.

Click on Generate Form E for 2020. Tax problems can be costly and confusing. Kelulusan Insentif Amaun Pendapatan Dikecualikan RM i.

This option may vary depending on what type of income tax you are filing and you can refer to this table to help. Tax payments checks only. Commission fees statement prepared by company to agents dealers distributors.

Pasport Passport no. No cash may be dropped off at any time in a box located at the front door of Town Hall. 65392 employers were fined andor imprisoned for not submitting Borang E in the Year of Assessment 2014.

As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b. Once the new page has loaded click on the relevant income tax form for the year. Kelulusan Ejen Cukai.

Once that is done click on Download Form E sign and submit via E-Filing. Employees can pay off income tax arrears in installments using the additional. Keluar Exit Maklumat Firma Ejen Cukai Particulars of Tax Agents Firm.

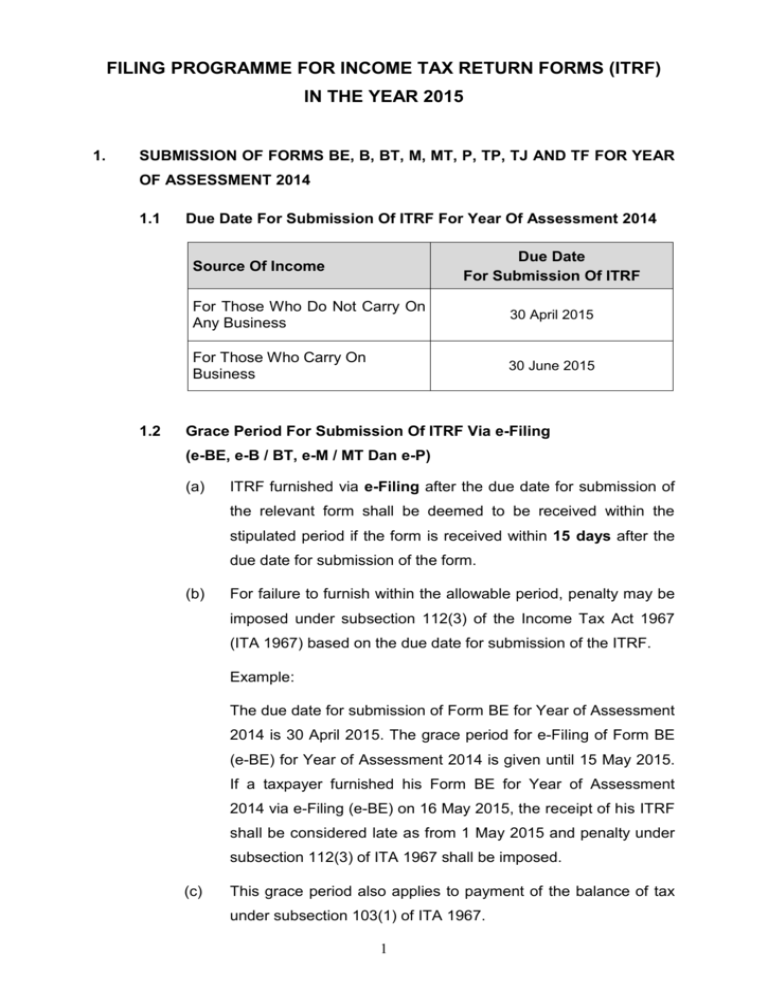

The due dates for submission are as follow. This form ea must be prepared and provided to the employee for income tax purpose cp8a - pin. Preparing and filing monthly withholding personal income tax return Preparing and filing annual personal income tax return.

请问我要怎么知道我已经Register Income Tax 呢 我有收到cukai pendapatan的来信但是我要在login的时候却忘记密码当我按Forgot Password再输入我的IC号码却显示Digital Certificate does not exist所以代表说我没有注册过吗. Appointment at 201 208-2200. Borang yang ditetapkan di bawah Seksyen 152 Akta Cukai Pendapatan 1967 Form prescribed under Section 152 of the Income Tax Act 1967 CP 4 - Pin.

700 malam hingga 700 pagi. Employers Form E by 31 March 2017. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian.

With Talenox Payroll you can submit Borang E in just 3 steps. PART A. 02 April 2020 Khamis hingga 03 April 2020 Jumaat.

So foreign workers who work in Malaysia for more than 182 days are considered as residents will follow the same tax guidelines as Malaysian. Helps low income NJ and NY residents who have tax problems and who cant afford to hire a professional. Nota Penerangan Borang P Form P Explanatory Note.

MAKLUMAT ASAS BASIC PARTICULARS A1 Nama Name A2 No. 2019 1 Nama perkongsian 2 3 4 A1 Kod A2 A3 A4 Kenaan imbangan A5 A6 No. Residents and non-residents with non-business income Form BE and M by 30 April.

Lembaga Hasil Dalam Negeri Malaysia LHDNM telah memaklumkan kepada semua pembayar cukai Tahunan Taksiran 2021 boleh mula mengisi E Filing. This form is prescribed under section 152 Income Tax Act 1967.

Lsy Outsource Accounting Services Posts Facebook

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

Important Dates For 2022 Tax Returns Leh Leo Radio News

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

Cp55d Form Fill Out And Sign Printable Pdf Template Signnow

How To Generate E Form Cp8d Actpay Payroll

Anas Sazali Anas Sazali Added A New Photo

Taxes Take A Racial Twist Irb Labels Viral Data

How To Easily Prepare Borang E Ea E Data Praisi And Otosection

Stm1 Form Fill Online Printable Fillable Blank Pdffiller

Business Income Tax Malaysia Deadlines For 2021

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

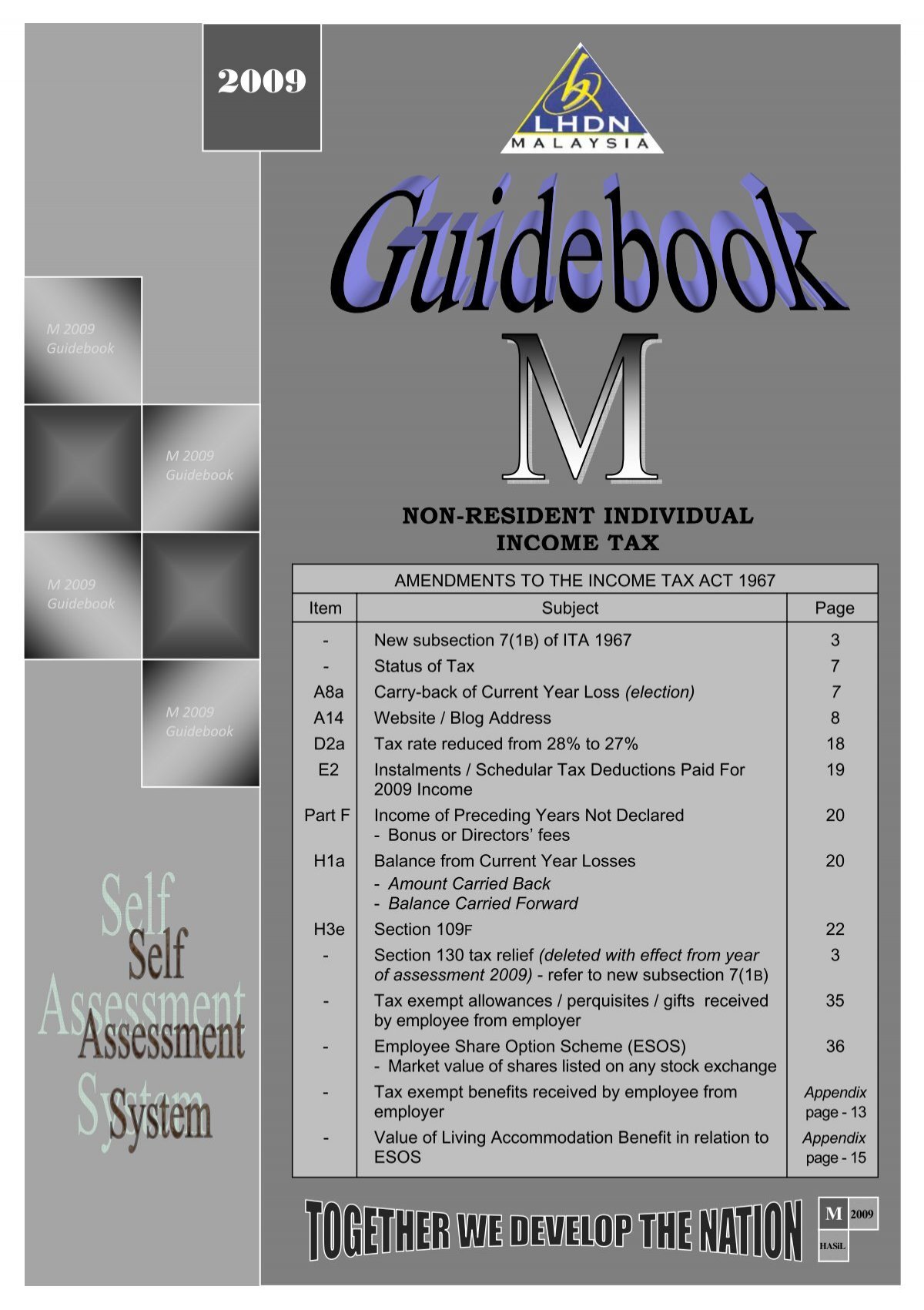

Program Memfail Borang Tahun 2009 Dan Isu

How To Step By Step Income Tax E Filing Guide Imoney

Cp650 Income Tax Fill Online Printable Fillable Blank Pdffiller

How To Fill In Cp30 Fill Online Printable Fillable Blank Pdffiller

Non Resident Individual Income Tax Lembaga Hasil Dalam Negeri